Difference between revisions of "Sparse Apertures for Next Generation Optical Space Telescopes"

(→DSM Allocation: Updated with figures and description) |

|||

| Line 37: | Line 37: | ||

[[File:Spacetelescopes2.png|none]] | [[File:Spacetelescopes2.png|none]] | ||

== Strategic Drivers and Alignment of Key Figures of Merit == | |||

Sparse Aperture Imaging LLC. (SAIL) is a new start-up venture that plans to compete in the rapidly growing Earth imaging marketplace. This market is dominated on the high performance end by vendors such as Lockheed Martin, who have an exquisite sensor with a 1.1 [m] primary mirror on their WorldView-3 satellite. On the opposite side of the spectrum, PlanetLabs competes with constellations of satellites with smaller apertures between 0.9 [cm] - 35 [cm], but provide imagery that is significantly less expensive. In addition, there is also free, publicly available imagery from satellites such as the ESA Sentinel with much lower resolution. | |||

Based on these competitors, SAIL has decided to compete in the medium-to-high resolution arena by out-performing PlanetLabs. However, to keep costs low compared to high performance sensors with monolithic meter-class primaries, SAIL will employ a sparse aperture imaging approach. This roadmap seeks to evaluate the approach that is most suitable for achieving these strategic drivers and hitting the FOM targets laid out in the table below. These targets are grounded in market data from existing systems as well as performance models of the potential gains from sparse aperture systems. | |||

{| class="wikitable" | |||

|- | |||

! !! Strategic Driver !! Alignment and Targets | |||

|- | |||

| 1 || Use sparse aperture imaging technology to drive down the effective aperture per kg of the system (which could be a single satellite or multiple flying in formation). This tightly coupled to the total system cost, driver 3. || 0.01 [m/kg]: Effective aperture per kg | |||

PlanetLabs Dove satellites have one of the highest ratios of effective aperture per kg for imaging satellites because of their small, cubesat form factor, ~ 0.02 [m/kg]. Because mass increases exponentially with aperture, high resolution systems such as WorldView-3 are ~ 0.0004 [m/kg]. | |||

|- | |||

| 2 || Provide medium to medium/high resolution data that is able to meet the majority of customer needs using a modular, sparse aperture architecture. || 0.75 [mrad] - 1 [mrad]: Angular Resolution* (panchromatic) | |||

State of the art satellite imagery able to achieve 0.5 [mrad] panchromatic imagery with private satellites such as WorldView-3. This imagery is sold at a premium. Publicly available imagery from satellites such as Sentinel can provide 12 [mrad] resolution. Relatively in-expensive imagery from PlanetLabs is between 8 - 1.5 [mrad] resolution (RGB). | |||

|- | |||

| 3 || Offer imagery at a competitive price by keeping total system cost low compared to current state-of-the-art systems. || 20 [millions of $]: Total System Cost (build and launch of 0.75 [mrad] angular resolution system) | |||

Launch costs are a large driver of the total system cost for satellite program. Current imaging satellites with the highest performance are extremely large and therefore require a dedicated launch vehicle, and costs between $60<sup>1</sup> and $150<sup>2</sup> million depending on the launch provider and orbit. SAIL will plan to use smaller satellites that can be launched as ride-shares. This can drive the launch cost down to ~ $5 million (6x - 30x cost reduction). In addition, smaller satellites using cubesat form factors are significantly less expensive. The SkyBox satellites are approximately $5 million<sup>3</sup> to build, compared to $650 million<sup>4</sup> for WorldView-3 | |||

|} | |||

Note*: Ultimately, the ground resolution is a function of the angular resolution and the satellite orbital altitude. Since the orbit can be varied independently (to a large degree), the angular resolution is the best FOM for comparing the capability of the capability of different systems. | |||

References: | |||

# https://www.airspacemag.com/space/is-spacex-changing-the-rocket-equation-132285884/ | |||

# https://en.wikipedia.org/wiki/Atlas_V#Launch_cost | |||

# https://www.forecastinternational.com/archive/disp_pdf.cfm?DACH_RECNO=1252 | |||

# https://en.wikipedia.org/wiki/WorldView-3 | |||

Revision as of 13:57, 3 November 2019

Technology Roadmap Sections and Deliverables

This technology roadmap is identified as follows:

- 2SASOT - Sparse Aperture Space Optical Telescope

This a Level 2 roadmap that evaluates sparse aperture optical telescopes that can achieve larger effective aperture. This feeds into a Level 1 roadmap for next generation space optical telescopes, which includes separate categories like monolithic or segmented telescopes. A Level 3 roadmap would describe the technological progress required to achieve a particular sparse aperture technique (deployable, formation flying, or erecting on-orbit). A Level 4 roadmap would describe individual enabling technologies such as on-orbit alignment metrology, and precision formation flying control algorithms.

Roadmap Overview

The angular resolution of a telescope is proportional to the size of the aperture. The mass and thus cost of space telescopes increases exponentially with aperture diameter. There is a need for systems that can produce the equivalent of a large aperture with low mass. This can be achieved by creating a synthetic aperture using multiple sub-apertures. One method to achieve this is to create a large number of small spacecraft, flying in a formation that creates the synthetic aperture.

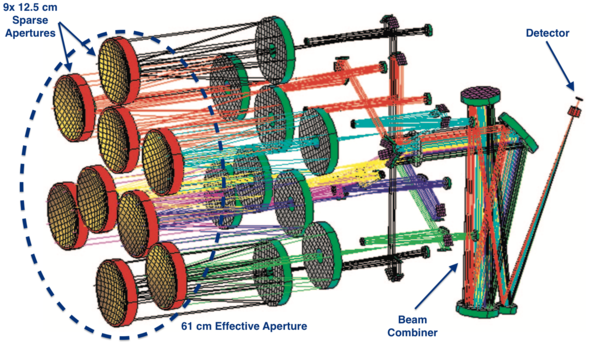

Currently, a sparse aperture space telescope has not yet been fielded. In 2006, Lockheed Martin built a laboratory demonstration of a sparse aperture space telescope, which is depicted in the figure below. Currently, the technology appears be at approximately TRL 4. Research has proven the feasibility of the technology, however, significant technology development must be completed before a space technology demonstration is ready.

DSM Allocation

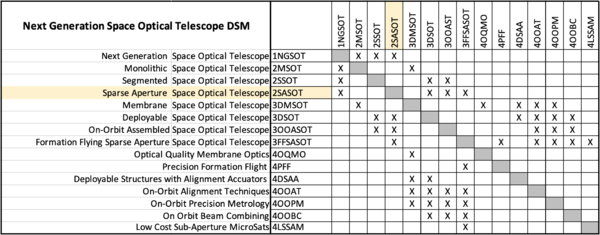

The design structure matrix for space optical telescopes is shown in the figure below. This DSM starts at Level 1.

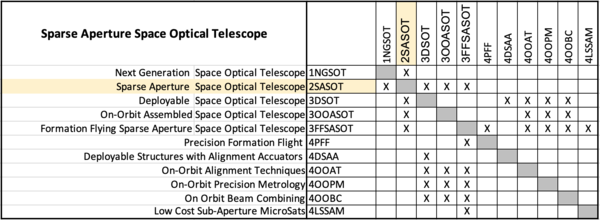

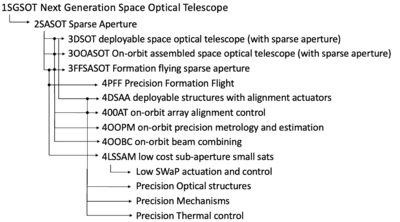

From this top level DSM, we can extract a Level 2 DSM specifically for Sparse Aperture Space Optical Telescopes (SASOT), which is provided below. This matrix can also be view in tree form. Here we can easily see that there are several enabling technologies required to develop SASOTs that are common to all Level 3 instantiations (deployable, on-orbit assembly, formation flying). There are also some technologies that are only feed one Level 3 SASOT, so such as low cost sub-aperture small sats enabling formation flying sparse apertures. Finally, the DSM tree includes some lower level technologies there are also important, but do not have their own specific roadmap identifier at this time.

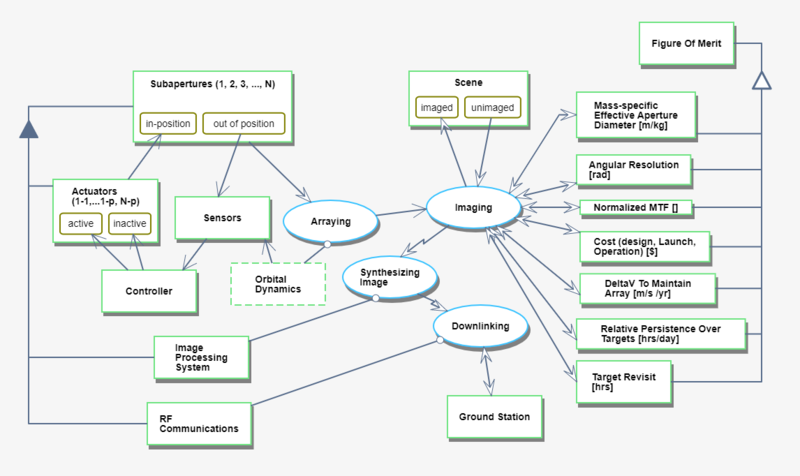

Roadmap OPM Model

An Object Process Model is presented for a formation-flight synthetic aperture imaging system.

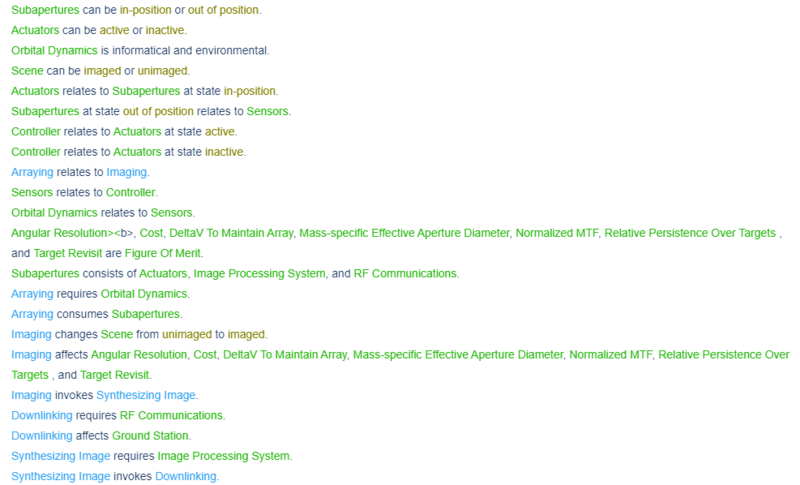

Figures of Merit

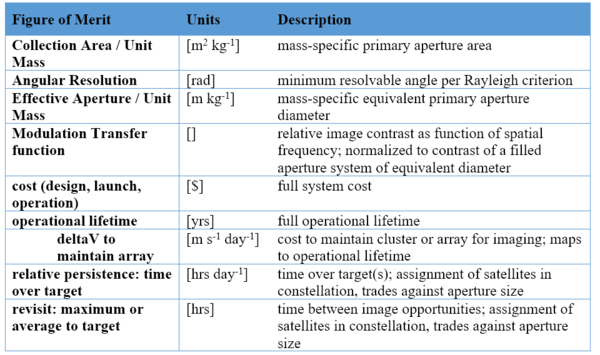

One key figure of merit is the mass-specific effective aperture. The figure below shows the progression of this figure of merit over time from early Earth-reconnaissance satellites, to the filled-aperture space telescopes in the past 30 years, to the next generation of synthetic aperture systems that extend the pareto front.

Strategic Drivers and Alignment of Key Figures of Merit

Sparse Aperture Imaging LLC. (SAIL) is a new start-up venture that plans to compete in the rapidly growing Earth imaging marketplace. This market is dominated on the high performance end by vendors such as Lockheed Martin, who have an exquisite sensor with a 1.1 [m] primary mirror on their WorldView-3 satellite. On the opposite side of the spectrum, PlanetLabs competes with constellations of satellites with smaller apertures between 0.9 [cm] - 35 [cm], but provide imagery that is significantly less expensive. In addition, there is also free, publicly available imagery from satellites such as the ESA Sentinel with much lower resolution.

Based on these competitors, SAIL has decided to compete in the medium-to-high resolution arena by out-performing PlanetLabs. However, to keep costs low compared to high performance sensors with monolithic meter-class primaries, SAIL will employ a sparse aperture imaging approach. This roadmap seeks to evaluate the approach that is most suitable for achieving these strategic drivers and hitting the FOM targets laid out in the table below. These targets are grounded in market data from existing systems as well as performance models of the potential gains from sparse aperture systems.

| Strategic Driver | Alignment and Targets | |

|---|---|---|

| 1 | Use sparse aperture imaging technology to drive down the effective aperture per kg of the system (which could be a single satellite or multiple flying in formation). This tightly coupled to the total system cost, driver 3. | 0.01 [m/kg]: Effective aperture per kg

PlanetLabs Dove satellites have one of the highest ratios of effective aperture per kg for imaging satellites because of their small, cubesat form factor, ~ 0.02 [m/kg]. Because mass increases exponentially with aperture, high resolution systems such as WorldView-3 are ~ 0.0004 [m/kg]. |

| 2 | Provide medium to medium/high resolution data that is able to meet the majority of customer needs using a modular, sparse aperture architecture. | 0.75 [mrad] - 1 [mrad]: Angular Resolution* (panchromatic)

State of the art satellite imagery able to achieve 0.5 [mrad] panchromatic imagery with private satellites such as WorldView-3. This imagery is sold at a premium. Publicly available imagery from satellites such as Sentinel can provide 12 [mrad] resolution. Relatively in-expensive imagery from PlanetLabs is between 8 - 1.5 [mrad] resolution (RGB). |

| 3 | Offer imagery at a competitive price by keeping total system cost low compared to current state-of-the-art systems. | 20 [millions of $]: Total System Cost (build and launch of 0.75 [mrad] angular resolution system)

Launch costs are a large driver of the total system cost for satellite program. Current imaging satellites with the highest performance are extremely large and therefore require a dedicated launch vehicle, and costs between $601 and $1502 million depending on the launch provider and orbit. SAIL will plan to use smaller satellites that can be launched as ride-shares. This can drive the launch cost down to ~ $5 million (6x - 30x cost reduction). In addition, smaller satellites using cubesat form factors are significantly less expensive. The SkyBox satellites are approximately $5 million3 to build, compared to $650 million4 for WorldView-3 |

Note*: Ultimately, the ground resolution is a function of the angular resolution and the satellite orbital altitude. Since the orbit can be varied independently (to a large degree), the angular resolution is the best FOM for comparing the capability of the capability of different systems.

References: